Table of Content

- What is Toast Payroll?

- Benefits of Toast Payroll

- Toast Payroll Training (Mastering Your Restaurant Payroll)

- Learning Paths for Toast Payroll

- Additional Resources

- Tips for Effective Training

- Getting Started with Toast Payroll

- Is Toast Payroll Right for You?

- Toast Payroll vs. Alternatives

- Toast Payroll Customer Support

- Key functionalities of the App

- Toast Payroll Pricing

What is Toast Payroll?

Toast Payroll is an all-in-one HR solution designed specifically for restaurants. It seamlessly integrates with Toast POS, allowing you to import timesheets directly into the payroll system. This eliminates manual data entry and reduces the risk of errors.

Benefits of Toast Payroll

- Reduced Time Commitment: Automating tasks like timesheet import saves valuable time you can dedicate to other aspects of your restaurant.

- Improved Accuracy: By eliminating manual data entry, Toast Payroll minimizes the chance of errors in payroll calculations.

- Simplified Compliance: Toast Payroll helps ensure you stay compliant with tax regulations and labor laws.

- Employee Self-Service: Employees can access their paystubs and tax documents electronically, reducing the burden on your HR team.

- Streamlined Onboarding: Toast Payroll simplifies the process of adding new employees to your payroll system.

Toast Payroll Training (Mastering Your Restaurant Payroll)

Running a restaurant demands a lot of attention, and ensuring smooth payroll is a vital but often time-consuming task. Toast Payroll aims to simplify this process, but even with a user friendly system, proper training can unlock its full potential.

Learning Paths for Toast Payroll

Toast provides a multi-faceted approach to Toast Payroll training, catering to different learning styles and needs:

- Onboarding: Toast guides you through a structured five-step onboarding process. This sets a strong foundation by familiarizing you with the system's core functionalities.

- Toast Classroom: This online platform offers a wealth of resources, including:

- Live Sessions: Attend interactive live training sessions conducted by Toast Payroll experts. Ask questions, get live clarifications, and gain valuable insights.

- Pre-recorded Courses: A library of pre-recorded courses is available covering various Toast Payroll topics at your own pace. Learn about setting up your system, processing payroll, managing employee data, and more.

- Help Center: A comprehensive online resource center (https://pos.toasttab.com/services/support) is your one-stop shop for articles, FAQs, and step-by-step guides. Search for specific functionalities or browse through categories to find solutions and best practices.

Additional Resources

Toast Webinars: Toast may host occasional webinars focusing on specific Toast Payroll features or updates. Keep an eye out for these informative sessions.

Downloadable Guides: Toast may provide downloadable guides or cheat sheets that offer quick reference for frequently used tasks or functionalities within Toast Payroll.

Tips for Effective Training

- Identify Training Needs: Start by assessing your team's existing knowledge and identify areas where training is most beneficial.

- Encourage Participation: Motivate your team to actively participate in training sessions, both live and pre-recorded.

- Schedule Training Time: Block out dedicated time for your team to attend training sessions and practice using the system.

- Utilize Resources: Don't hesitate to leverage Toast's comprehensive Help Center and downloadable resources for ongoing learning and reference.

Getting Started with Toast Payroll

Toast offers a variety of resources to help you get started with Toast Payroll, including:

- Onboarding: Toast provides a five-step onboarding process to guide you through setting up your payroll system.

- Training: Toast Classroom offers live and pre-recorded training sessions on various Toast Payroll topics.

- Support: Provides full assistance via email and a dedicated phone line.

Is Toast Payroll Right for You?

Toast Payroll is a valuable tool for restaurants of all sizes. Whether you have a small cafe or a large chain, Toast Payroll can streamline your payroll process and save you time and money.

Toast Payroll vs. Alternatives

| Feature | Toast Payroll | Square Payroll | ADP Workforce Now | Paycom |

|---|---|---|---|---|

| Restaurant-Specific | Yes | Yes (Limited) | No | No |

| Toast POS Integration | Seamless | None | None | None |

| Time & Attendance | Yes | Basic | Yes | Yes |

| Benefits Administration | Limited | Limited | Yes | Yes |

| Tax & Compliance | Yes | Yes | Yes | Yes |

| Employee Self-Service | Yes | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes | Yes |

| Pricing | Varies by business | Varies by business | Varies by business | Varies by business |

| Customer Support | Phone, Email, Help Center, Toast Classroom | Phone, Email, Help Center | Phone, Email, Chat | Phone, Email, Chat |

Toast Payroll Customer Support

Phone Support: A dedicated phone line is available for immediate assistance.

Email Support: If your inquiry isn't urgent, you can send an email to Toast Payroll's support team and expect a response within a reasonable timeframe.

Toast Payroll Help Center: A comprehensive online resource center (https://pos.toasttab.com/services/support) is available, providing articles, FAQs, and guides on various Toast Payroll functionalities. You can search for specific topics or browse through categories to find answers to your questions.

Toast Classroom: Toast offers live and pre-recorded training sessions (https://central.toasttab.com/s/toast-classroom) specifically designed for Toast Payroll. These sessions cover various aspects of the system, from setting up to troubleshooting common issues.

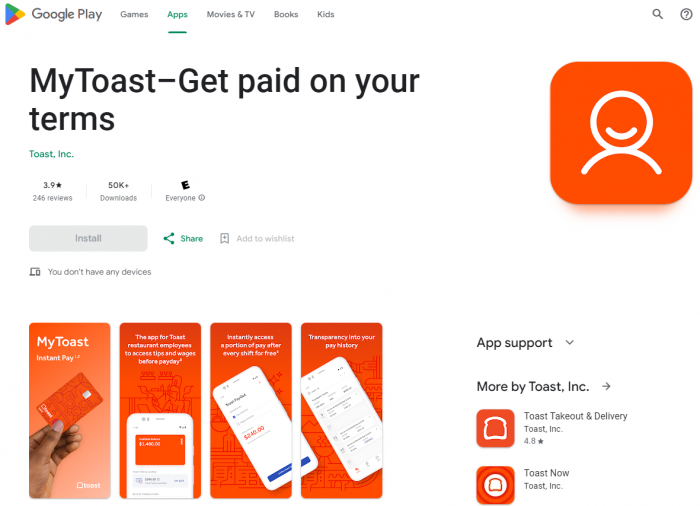

Key functionalities of the App

- View Paystubs: Employees can conveniently view their latest paystubs and past earning statements anytime, anywhere.

- Tax Documents: Access and download important tax documents like W-2s directly through the app.

- Review Pay History: Track past earnings and deductions with ease.

- Update Personal Information: Keep your contact details and other personal information up-to-date within the app.

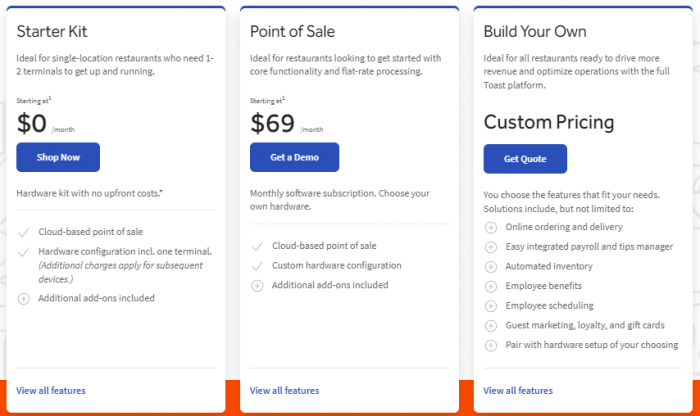

Toast Payroll Pricing

- Variable Pricing: Costs depend on your business needs, primarily the number of employees you have.

- Per Employee, Per Month (PEPM): Expect a base cost per employee, per month.

- Monthly Minimum: There may be a minimum monthly fee regardless of your employee count.

To get an accurate quote

- Contact Toast Sales directly.

- Be prepared to share details about your business and number of employees.

Post Comment

Be the first to post comment!

Related Articles

How Leading Companies Are Leveraging AI to Get Ahead

Apr 10, 2025