When venturing into the world of entrepreneurship, one of the most critical decisions you'll face is selecting the right business structure. This choice can impact your legal obligations, taxes, and operational framework.

Among the various options available, a corporation is a prevalent business structure for entrepreneurs looking to attract external investments. However, the pros and cons of choosing a corporation can vary depending on your business goals and how you plan to grow.

So, in this article, we’ll discuss the pros and cons of choosing a corporation to help you determine if it is the right fit for your business.

Let's get started.

What is a Corporation?

Before discussing the pros and cons of choosing a corporation, let’s understand what a corporation is.

A corporation is a formal business organization authorized and recognized by the state as a separate business entity.

A corporation's distinct legal entity status is a major defining characteristic and a significant factor when considering the pros and cons of choosing a corporation. This separation allows the corporation to enter into contracts, sue, and be sued in its own name.

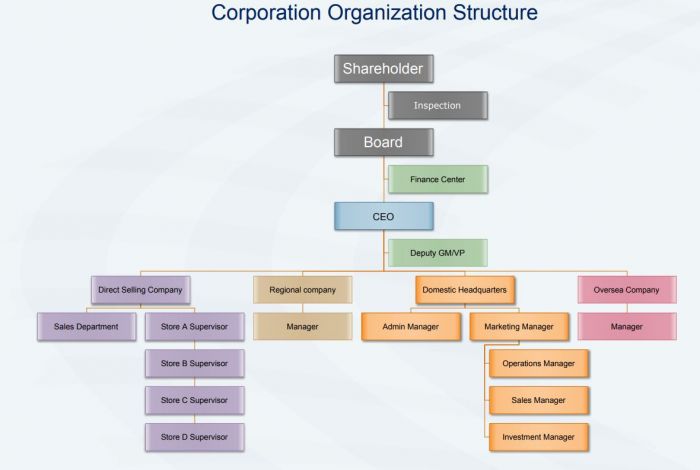

The structure of a corporation typically includes shareholders (owners), a board of directors who oversees major decisions, and officers who manage daily operations.

According to GovDocFiling, establishing a corporation is easy if business owners follow the right steps to register for this type of business structure. They can easily set up it with the help of an expert corporation starting and registering guide.

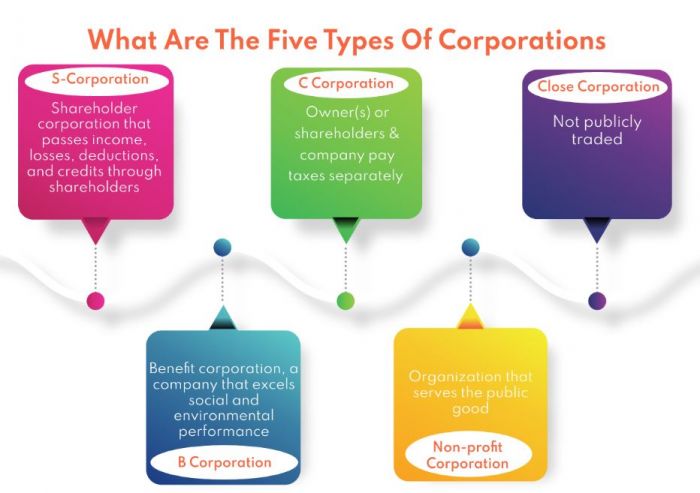

Also, there are different types of corporations, and the operational structure may align with the type formed.

Regardless of the type you choose, deciding to incorporate is a significant decision that requires careful consideration. So, it's crucial to thoroughly weigh the pros and cons before moving forward with this step.

Pros and Cons of Choosing a Corporation

As Attrock experts say, growth plans vary significantly whether you're running a startup or small business. So, the decision to incorporate should be driven by a thorough assessment of your business's specific needs and long-term goals.

Weighing these goals against the pros and cons of choosing a corporation can help you make an informed decision.

So, what are the pros and cons of choosing a corporation? Let's take a look at them.

Pros of Forming a Corporation

Here are some of the pros of forming a corporation:

- Limited Liability: One of the most significant advantages of forming a corporation is its protection of your personal assets. A corporation is considered a separate business entity from its owners. That means that if your business faces legal issues or debts, your personal assets are generally protected.

- Enhanced Credibility: Corporations are often perceived as more credible and stable than other business structures like sole proprietorships or partnerships. For an online business, it will be easier to attract investors, secure loans, market your business, and build trust with customers and suppliers if it is incorporated.

- Ability to Raise Capital: Corporations can raise substantial capital by issuing stock and selling shares to investors. These investors are often more willing to invest in corporations because of the structured management and financial transparency. This is a great advantage for businesses looking to expand rapidly.

- Tax Deductions: While corporations face double taxation, they can also enjoy tax credits and deductions, such as employee benefits and business expenses, that other business structures may not be entitled.

- Perpetual Existence: Unlike sole proprietorships or partnerships that dissolve upon the owner's death, withdrawal, merger, or acquisition, a corporation has a perpetual existence. This means the corporation can continue to exist even if there are changes in ownership or management. Similarly, the organizational structure of a corporation also contributes to ensuring its perpetual existence.

Cons of Forming a Corporation

The following are some of the cons of choosing a corporation:

- Increased Compliance Requirements: Corporations face more stringent regulatory requirements than other business structures. This includes filing annual reports, holding shareholder meetings, and maintaining detailed financial records. If you're looking for support in managing your business's finances, you can hire a bookkeeper to help keep things organized and running smoothly.

- Double Taxation: Double taxation is one of the most significant drawbacks of forming a corporation. The corporation's profits are taxed at the corporate level, and then dividends paid to shareholders are taxed again as personal income. This double taxation can increase the overall tax burden compared to other business structures.

- Complex Formation Process: Forming a corporation involves a more complex process than setting up a sole proprietorship or partnership. It requires filing articles of incorporation, creating bylaws, and complying with ongoing state and federal regulations. These requirements can be time-consuming and costly, often requiring businesses to hire tax professionals or accounting services.

- Potential Loss of Control: In a corporation, ownership is divided among shareholders, which can lead to a loss of control for the founders or owners. Decisions are made by the board of directors, which may not always align with the founders' vision. This potential loss of control can concern entrepreneurs who want to maintain autonomy over their business.

Final Thoughts

As you evaluate the pros and cons of choosing a corporation and consider your options, remember that the best business structure depends on your specific business needs, industry, and long-term objectives.

If you plan to scale your business and attract investors, the advantages of a corporation often outweigh the disadvantages. However, if you want to maintain sole control over your business operation and management, forming a corporation might not be the best business structure for you.

If you require assistance with your business structure, consider consulting with business experts and legal and financial professionals to ensure you make the most informed decision.

Post Comment

Be the first to post comment!

Related Articles

How to Maximize Security at Large Business Events

Apr 30, 2025

How Mesothelioma Victims Can Seek Legal Compensation

Apr 23, 2025