Reviews

5 min read

Is Primerica Legit?

Primerica, Inc., a major player in the financial services sector, caters primarily to middle-income households in the United States and Canada, offering a range of products including term life insurance and investment services.

Founded 40 years ago and headquartered in Duluth, Georgia, Primerica has grown significantly over the decades, now boasting over 2,000 corporate employees and around 130,000 independent representatives.

It is listed on the New York Stock Exchange under the symbol "PRI" and has consistently demonstrated financial stability and growth.

The company has been in the spotlight not just for its financial products but also due to various allegations and legal challenges it has faced over the years.

For instance, it has been involved in lawsuits concerning the advisement on retirement products, which were settled favorably for the plaintiffs in the past. Despite these challenges, Primerica has maintained a strong market presence and has been recognized as a trusted financial institution.

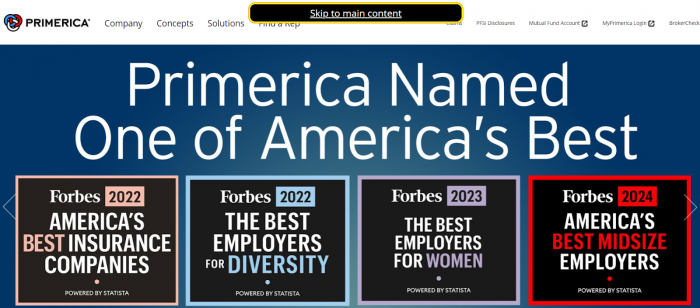

It was ranked as the #1 Most Trusted Life Insurance Company and the #3 Most Trusted Financial Company by reputable market analysts.

Primerica was founded in 1977 by Arthur L. Williams Jr. The company offers a range of financial products, including term life insurance, mutual funds, and annuities.

Primerica's mission is to help middle-income families achieve financial security by providing affordable financial solutions. The company operates primarily in the United States, Canada, and Puerto Rico, serving millions of clients.

Primerica's model includes a direct-selling approach, where agents earn through commissions rather than a salary, promoting a strong recruitment drive within the company.

This has led to debates about its business practices, often comparing it to multi-level marketing (MLM) structures. However, Primerica distinguishes itself by offering substantial financial products and insists that its compensation model is based on product sales rather than merely adding new recruits.

Overall, while Primerica has faced scrutiny and allegations, it continues to be a prominent and legitimate entity in the financial services industry, helping millions secure their financial futures with its insurance and investment solutions.

For anyone considering engagement with Primerica, whether as a customer or representative, it is advisable to conduct thorough research and consider both the benefits and the criticisms it has received over the years.

Primerica operates on a multi-level marketing (MLM) structure. Representatives, known as "Primerica representatives," earn money through direct sales of financial products and by recruiting new representatives. The MLM model allows representatives to earn commissions from their own sales as well as a percentage of the sales made by their recruits. Primerica provides extensive training and support to its representatives, including licensing assistance and ongoing education.

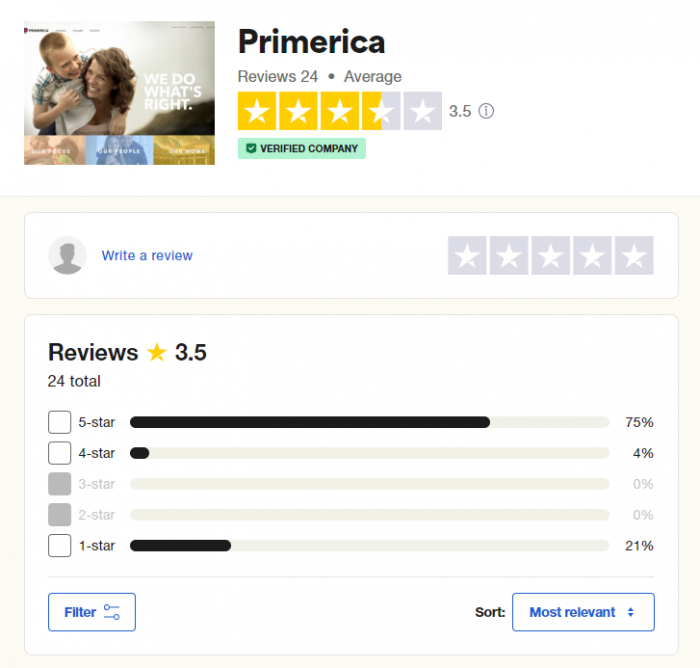

1. Trustpilot:

Primerica holds an average rating of 3.5 out of 5 stars on Trustpilot. Positive reviews highlight the company’s dedication to financial education and support for representatives.

Negative reviews focuses on the MLM structure, with some users feeling pressured to recruit new members and purchase products.

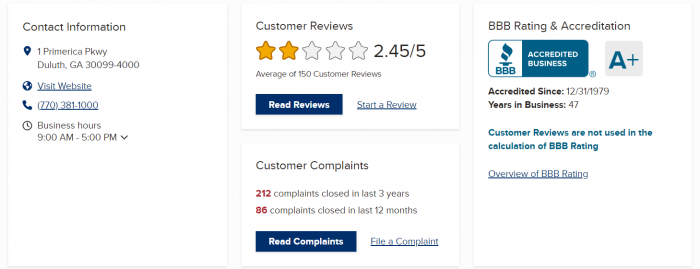

2. Better Business Bureau (BBB):

Primerica has an A+ rating from the BBB, indicating strong customer service and resolution practices. The company has an average customer review rating of 2.45 out of 5 stars.

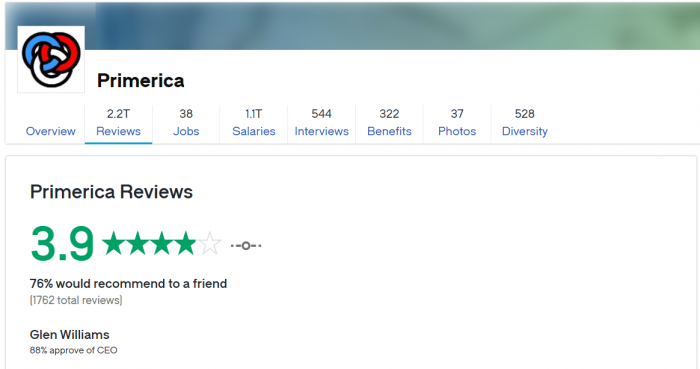

3. Glassdoor:

Employee reviews on Glassdoor provide insights into the working environment at Primerica. The company has an average rating of 3.9 out of 5 stars.

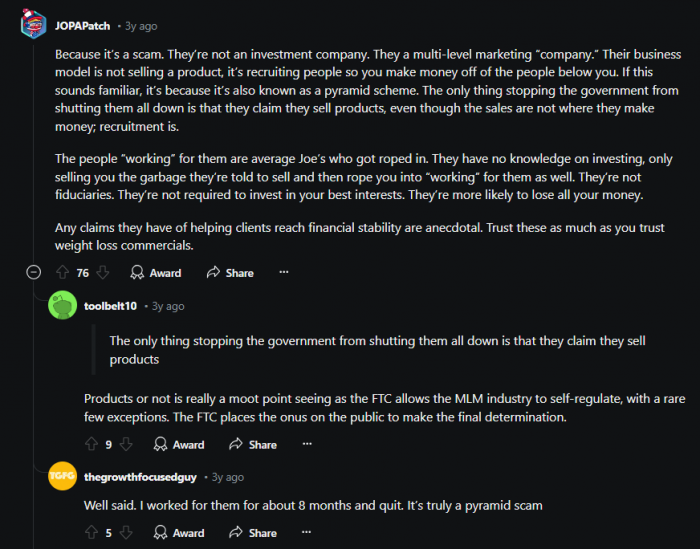

4. Reddit:

Reddit has a lot of discussion threads. We found some of the users specifically stating Primerica as a pyramid scheme.

In conclusion, Primerica is a legitimate financial services company with a long history and strong regulatory compliance.

While its MLM structure may not suit everyone, the company provides valuable financial products and services to middle-income families. As with any financial decision, it's crucial to conduct your own research and consider all aspects before making a commitment.

Yes, Primerica is currently under investigation. Law firms such as Block & Leviton and Bragar Eagel & Squire are investigating potential securities law violations by Primerica, incited by allegations of misleading conduct among its highest producing agents.

These investigations follow a significant drop in Primerica's stock value and are aimed at determining if there were any breaches in federal securities laws that might have affected investors adversely. These ongoing legal challenges are critical for investors and stakeholders trying to assess the company's compliance and governance standards.

Primerica is not a pyramid scheme as stated by Primerica on their website. It operates as a legitimate financial services company that is publicly traded and widely recognized in the industry.

The business model involves a network of independent representatives who earn commissions through the sale of insurance and financial products, not through the recruitment of new agents.

This structure allows representatives to build their own teams and increase client reach, but compensation is based on sales, not recruitment, distinguishing it from a pyramid scheme structure.

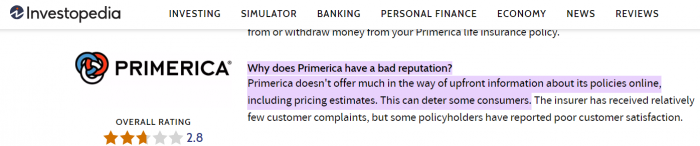

We found several several threads stating about Primerica bad practises.

We also found that Investopedia has also stated about Primerica. See below.

Be the first to post comment!