With the year 2025 projected to be a turning point for advanced businesses, it is clear that Innovate Technologies is indeed moving at a spearhead pace. Striking dismantles of market structure literally offer surpluses to consumers, which makes it easy for them to flourish. The main reason why consumers abilities are expanding is driven from primary technology, shifting preferences, and growths associated with regional governance policies.

Companies venturing in the new dynamic environment are highly scoping to achieve improvements in profit margins of fast growing sectors which are patience of massive global markets with their competitors in said innovative technologies. New market policies are being put in place alongside needed developments across the globe resulting to surging unanswered queries in the field of economic protection.

Financial Technology: Banking Without Borders

The financial sector has witnessed perhaps the most dramatic transformation. Decentralized finance platforms now manage over $340 billion in assets globally, representing a 215% increase from 2023 figures. These platforms operate with innovative regulatory approaches that challenge traditional banking's territorial limitations.

Take Nexo Financial, which utilizes a distributed licensing model across multiple jurisdictions. This approach has allowed them to offer services that would be impossible under any single country's regulatory framework. Their customer base has expanded by 78% this year alone.

"The regulatory arbitrage isn't the goal—it's a means to an end," explains a financial analyst. "These companies want to offer services that traditional banks simply cannot, and consumers are voting with their wallets."

Cross-border payment systems have similarly flourished. Companies like TransferWise and Ripple have established alternative rails that bypass the traditional SWIFT system, reducing transfer times from days to seconds while cutting costs by up to 70%.

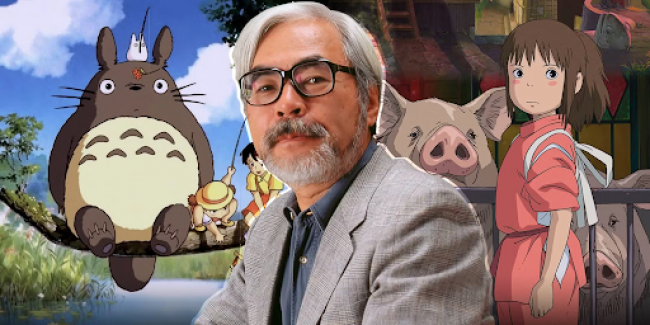

Entertainment Unbounded

The entertainment industry has undergone its own revolution. Streaming platforms increasingly employ global licensing models that sidestep regional restrictions that have traditionally fragmented content availability.

Platforms like Peachy Stream have pioneered a creator-first model where content producers retain rights and can distribute globally without navigating complex territory-by-territory licensing. This has resulted in a 43% increase in international content availability compared to traditional streaming services.

Independent production houses operating from countries with more flexible intellectual property frameworks, such as Singapore and Estonia, have become unexpected powerhouses. These companies produce content that can be distributed globally without the restrictions that hamper traditional Hollywood studios.

Gaming and Gambling: Alternative Ecosystems

Perhaps nowhere is the trend toward alternative regulatory models more evident than in online gaming and gambling. The sector has fractured into multiple ecosystems, each operating under different regulatory philosophies.

Traditional operators remain constrained by country-specific regulations that can limit game offerings and player options. In contrast, alternative platforms operate with different regulatory approaches that often provide more variety and fewer restrictions.

The consumer demand for these alternatives has grown substantially. Market research indicates a 37% increase in players seeking platforms outside traditional regulatory systems. Many consumers turn to a list of Non Gamstop sites when looking for gaming experiences with different player protections and options. These alternative platforms typically offer more diverse gaming experiences while implementing their own responsible gambling measures. Rather than following a one-size-fits-all regulatory approach, they tailor protections to different player profiles and behaviors.

Future Implications

The success of these business models suggests a potential rethinking of regulatory frameworks globally. Forward-looking jurisdictions have begun experimenting with "regulatory sandboxes" that allow innovation while maintaining basic protections.

The United Arab Emirates, for instance, has established special economic zones with bespoke regulatory frameworks designed specifically for digital businesses. These zones have attracted over $8.3 billion in investment during 2024 alone.

For businesses that are more developed, this shift comes with both opportunities and challenges. Businesses willing to adapt to these new paradigms, such as creating subsidiaries structured to run under different models, can take advantage of new market opportunities that more conventional strategies are unable to address.

Balancing Innovation and Protection

The rise of alternative business frameworks does not spell the end of regulations; it signals their evolution. The most successful disruptive businesses often practice the harshest form of self-governance, particularly in particular, the area of security and consumer protection policies.

As traditional forms of regulating these shifts undergo modernization, the blend of alternative and mainstream could be more pronounced than ever. Businesses that will lead the decade are the ones who will navigate seamlessly between the two, providing adequate innovation while employing sufficient safeguards to garner consumer trust and appetite.

The sheer number of alternatives to these conventional systems available to consumers means increased choice, greater accessibility, and a greater expectation of personalized services. The obstacle will be in exercising intelligence when operating within this widening marketplace.

Post Comment

Be the first to post comment!

Related Articles